I know this blog is mainly an engineering blog, but this is something I struggled to learn and thought blogging my findings would be helpful for my friends who want to learn about their investments or evaluate and compare offers.

The following are a result of my findings after an hour long phone call with Fidelity representative. I opened the chat section in my browser and asked to speak with someone. They gave me a phone number. And they’re available Monday - Sunday til midnight EST. I was waiting on the line for about 7-8 minutes. I had an hour long great conversation + along with some follow up questions with some friends. After 3 yrs of being an employee I finally got answers. Please note I made some changes to the actual numbers. The screenshots are just for demonstration purposes.

So at my company, I get:

- Restricted Stock options (RSU or RS)

- Stock option Plan (SOP)

- 401k

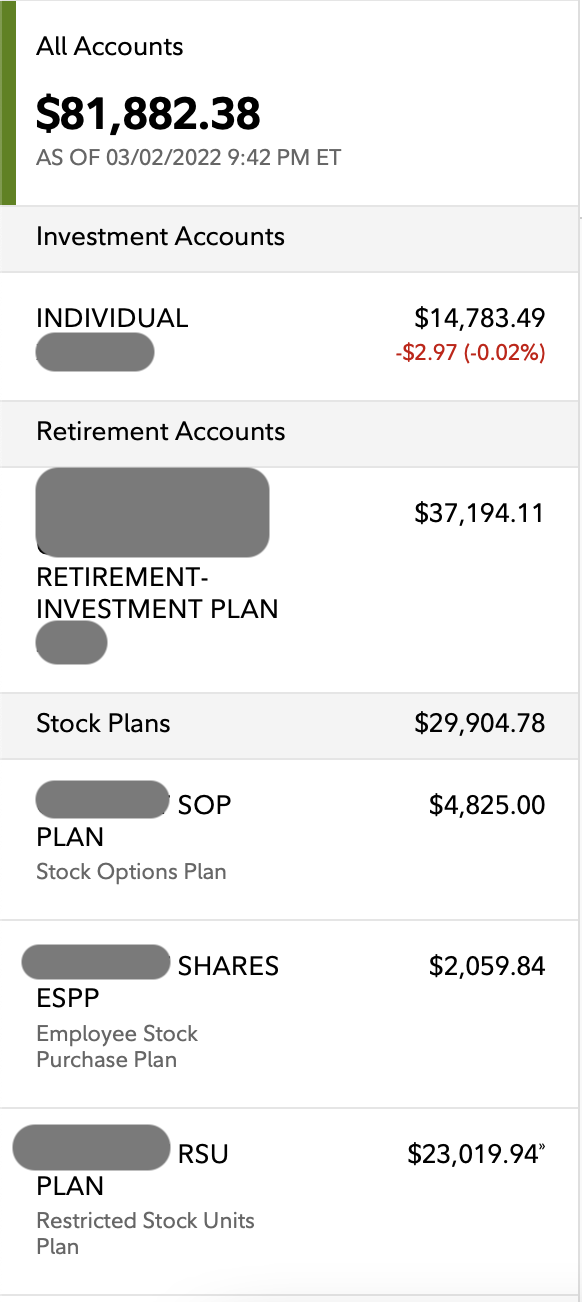

But the ‘account list’ on the left is slightly vague. It looks like this:

And I was never able to tell how much I actually currently have if I was to leave the company today and how much of it is unvested and will be lost if I leave.

Quick breakdown

- Individual: All your vested or bought stocks

- vested (by RSUs)

- bought (by ESPP)

- Retirement account

- Stocks that are granted but not vested yet.

- SOP

- ESPP

- RSU

The Individual sections/accounts are **already** vested and taxed.

The Retirement account is tax-deferred. It's all yours i.e. no vesting, but you'll end up paying taxes when you cash them. If you cash them before 65 then you'll also pay a penalty!

The stocks section is the portion of your stocks/options that isn't vested. As it's only been granted.

RSU Vesting schedule

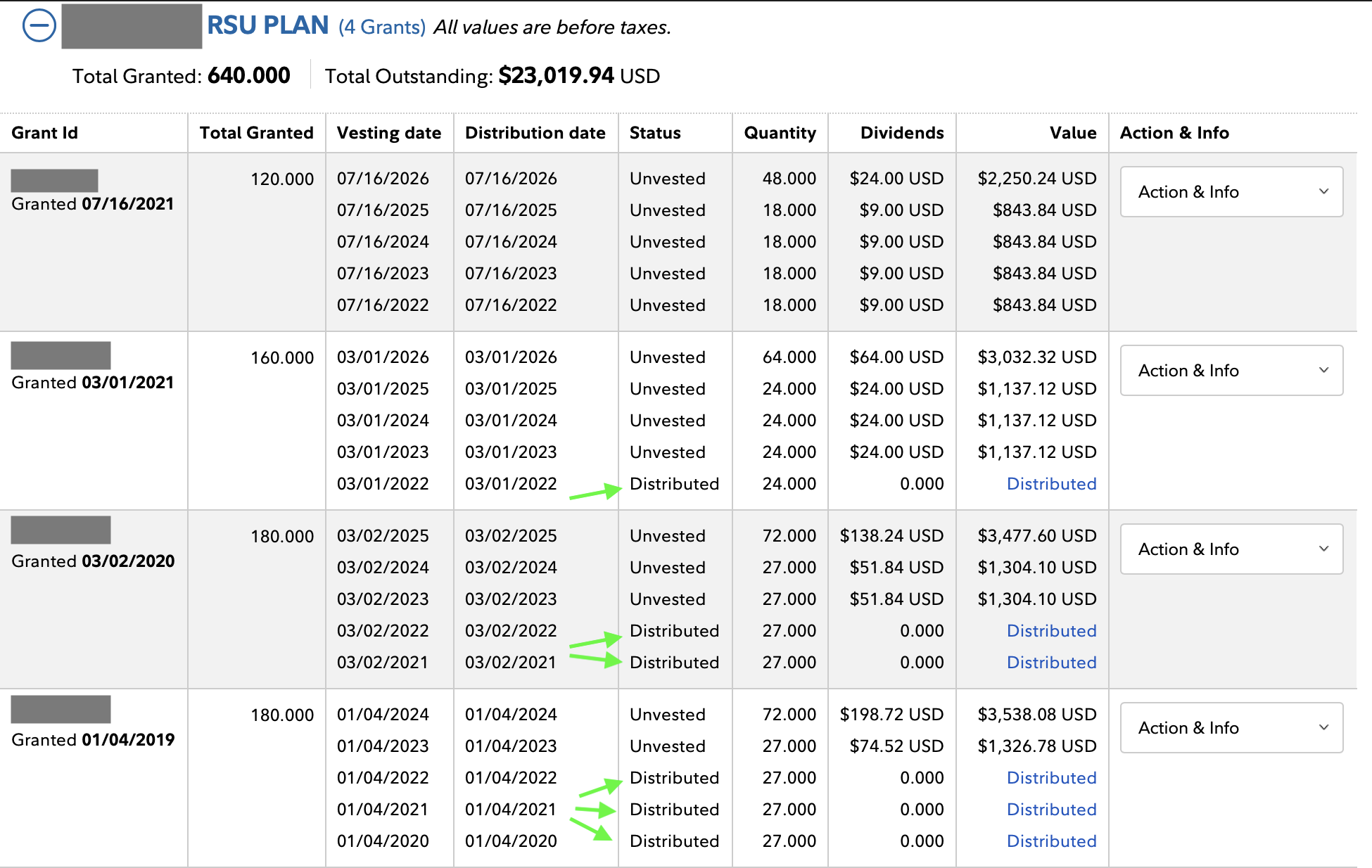

Note: Stocks are granted at their designated time. Then they need to get Distributed and vested. Once they get granted, your distribution time table depending on your company will be like:

- 15% first year distributed.

- 15% second year distributed.

- 15% third year distributed.

- 15% forth year distributed.

- 40% fifth year distributed.

or

- 25% first year distributed.

- 25% second year distributed.

- 25% third year distributed.

- 25% forth year distributed.

Either on the same day of distribution or 3 days later, the distributed stocks will get finally vested. For the most part distributed and vested are 100% the same day.

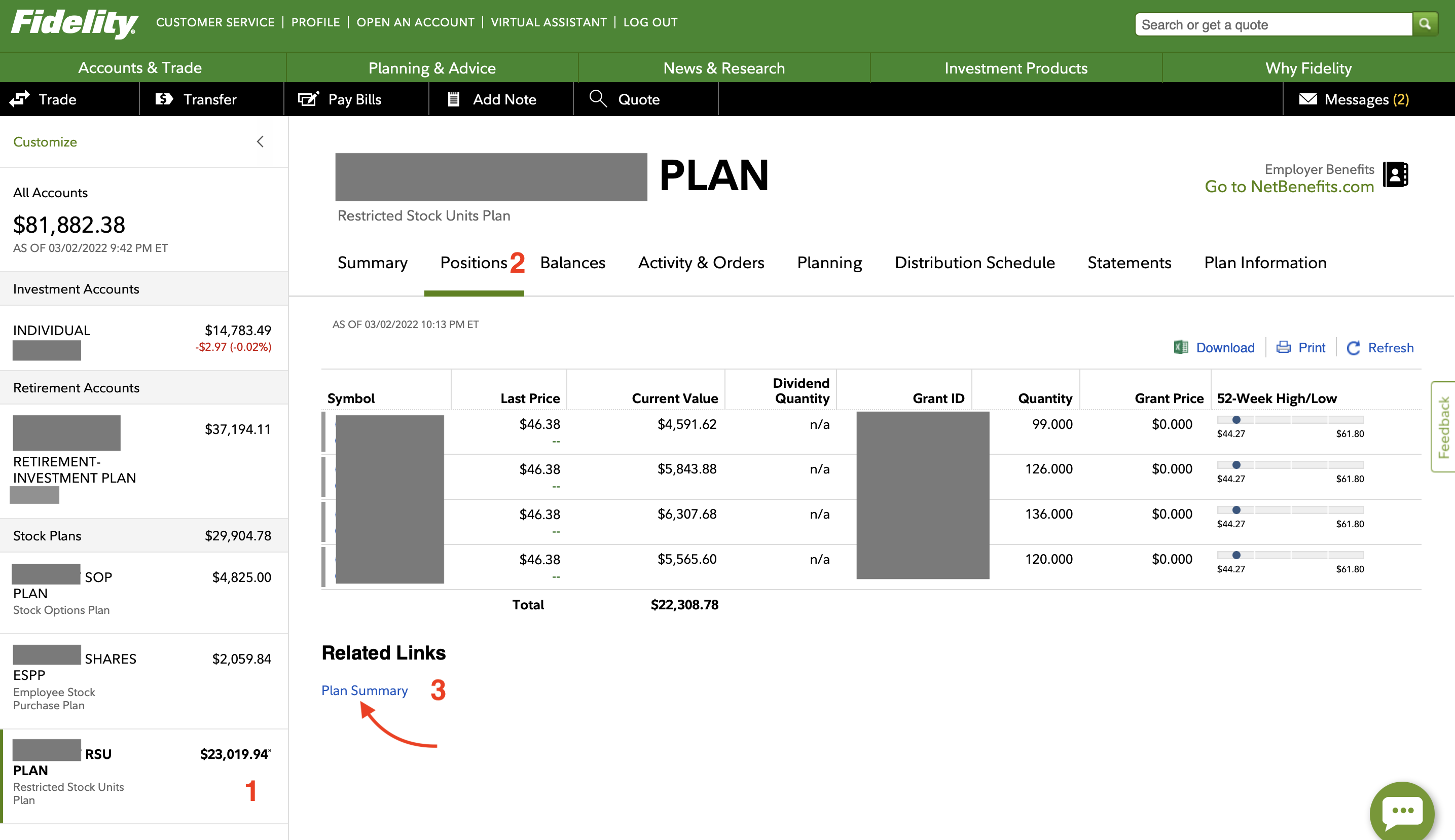

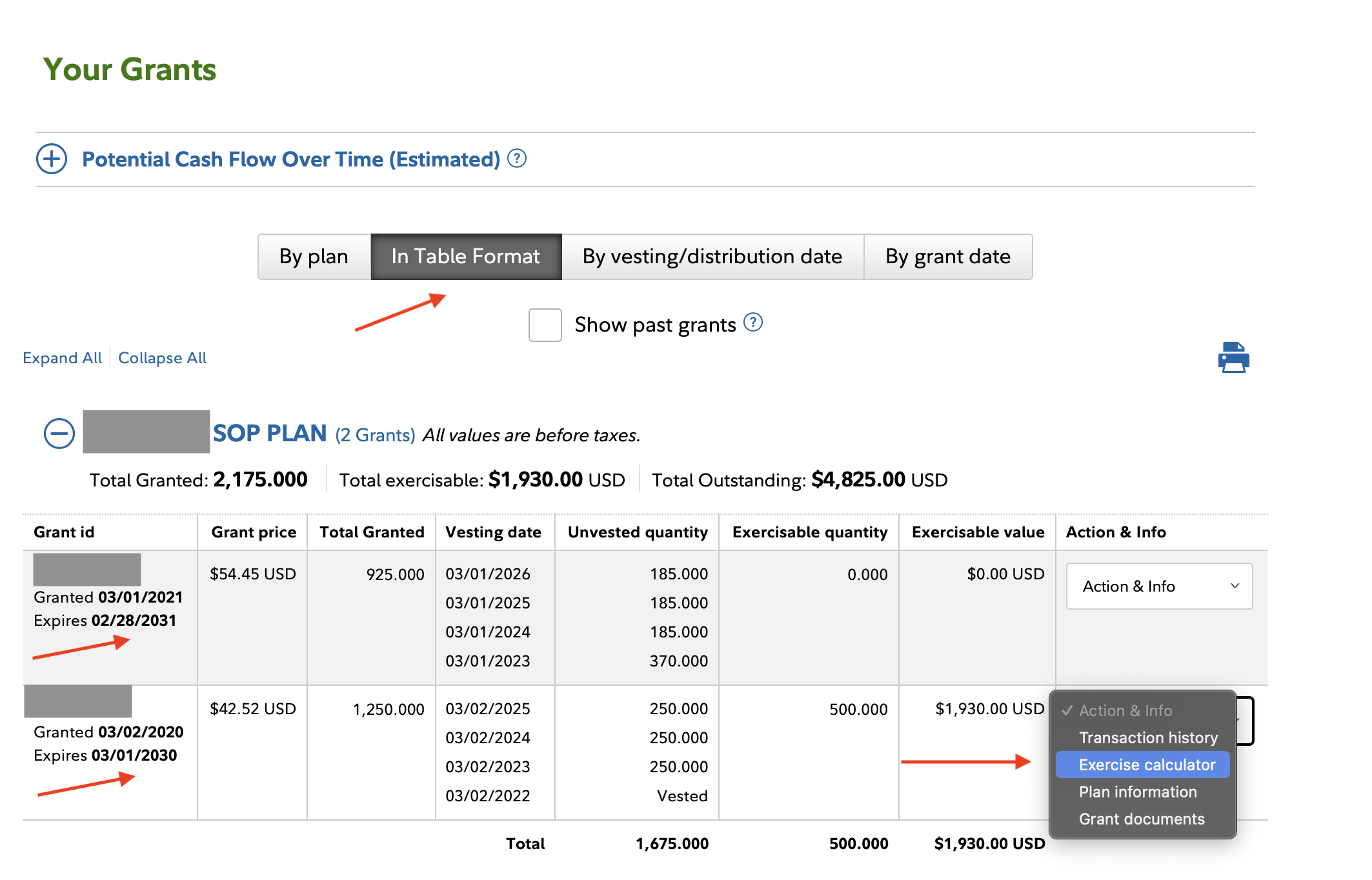

To see the distribution plan/table, follow the arrows sections:

Sample distribution:

To see in this view, make sure you’ve selected In Table Format.

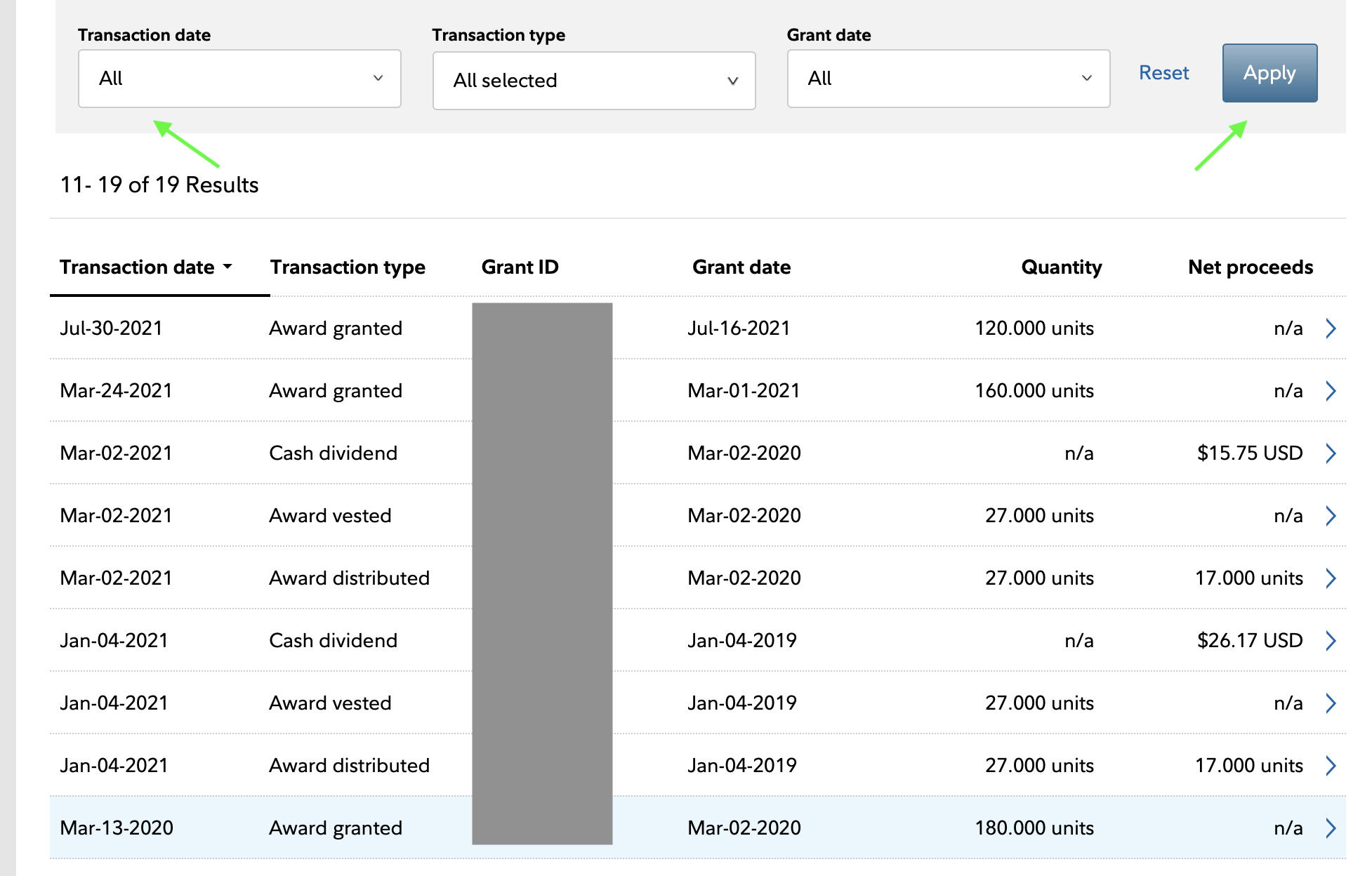

If you want to see the your the timeline of the vesting of a specific grant, then from the above screen:

- Select the ‘Account & Info’ dropdown

- Then select the ‘Transaction history’ dropdown.

You’ll get landed to such a page:

Adjust the ‘Transaction Date’ and ‘Grant Date’ if needed and hit Apply.

Why is my stock value far less than my actual RSUs?

Because you pay income taxes when they get vested. And whenever you sell the vested stocks then you get taxed for capital gains (profit or loss) between the sell price and vesting price.

Example:

- You’re granted a single stock at $200 at 2020.

- It gets vested at $400 at 2021.

- You sell it for $500 at 2025.

For tax purposes, the grant price/date isn’t important.

- In 2021 you’ll have $400 as taxable income.

- In 2025, you’ll have $100 as an increase in your capital gains tax. ($500 - $400 = $100)

Do I have to file taxes for each year for my RSUs?

- Vesting: Whenever it vests, very likely it’s already included in your W2 and you get taxed as income tax.

- Cashing: But if you’re selling then stocks, then you just have to pay capital gains tax.

For taxes about options. See here

Should I sell my stocks now?

So if you sell your stocks today, then whatever profit you have will be considered in this year’s taxes. Typically when you’re working you already have like ~$100,000 as your salary, and if you sell your stocks you’re just adding more to your income. More income might get into a higher tax bracket.

But if you don’t cash on it until you’re retired, then you’re selling it in a year where your income is ~$0 (because you don’t have any income salary). So your tax bracket is lower.

How do I change my ESPP contribution rate?

For my company we’re only allowed to do that in the first two weeks of every quarter. During a quarter we can only set it back to %0 i.e. for my account I wasn’t able to reduce it from %10 to %5.

How to access it: Portfolio » Stock Plans » ESPP Contribution Balance » Change Contribution Rate

I’m not sure why but it has two (current and future) offerings. I believe those are for my current quarter and upcoming i.e. I wasn’t given an option to change it for current and all upcoming offerings.

What’s a Stock Option?

From here:

Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Options aren’t actual stocks when they vest, they’re not worth anything. They’re an option to buy stock at a specific (hopefully lower) price than the stock currently trades at. If the current price is lesser than the option price then you won’t exercise it at all.

Pre-IPO options are not super valuable because you can’t sell the stock (not 100% true but mostly true) but the idea is that post-IPO, now you can buy all this stock at $6 that’s worth $20 or whatever. So you can buy for 6 and sell for 20.

But that’s a big capital gains event, you’re making 20-6 $ per stock, and you’ll owe that at the end of the year.

Most brokerages have a “buy and sell immediately” thing, with a “sell for cover” option that means that you don’t actually have to put in the $6, they’ll lend you the $6 for 10 milliseconds, so you’ll just get $20-$6 per share in cash

Does the Options selling get reported in my W2?

No. You have report that yourself. Because your company isn’t aware of your Option trading/sales. Only your brokerage knows of that.

How much time do I have to exercise my SOPs?

Typically it’s good for 10 yrs after the grant date while you’re at the company.

When you leave it’s 90 days. But companies are different. Also every individual’s contract is different. So ask your HR department about how much time you have to exercise it after you’ve left the company.

You’d usually exercise it when your stock is doing good.

Is there a way for me to see how much I get if I exercise my SOPs?

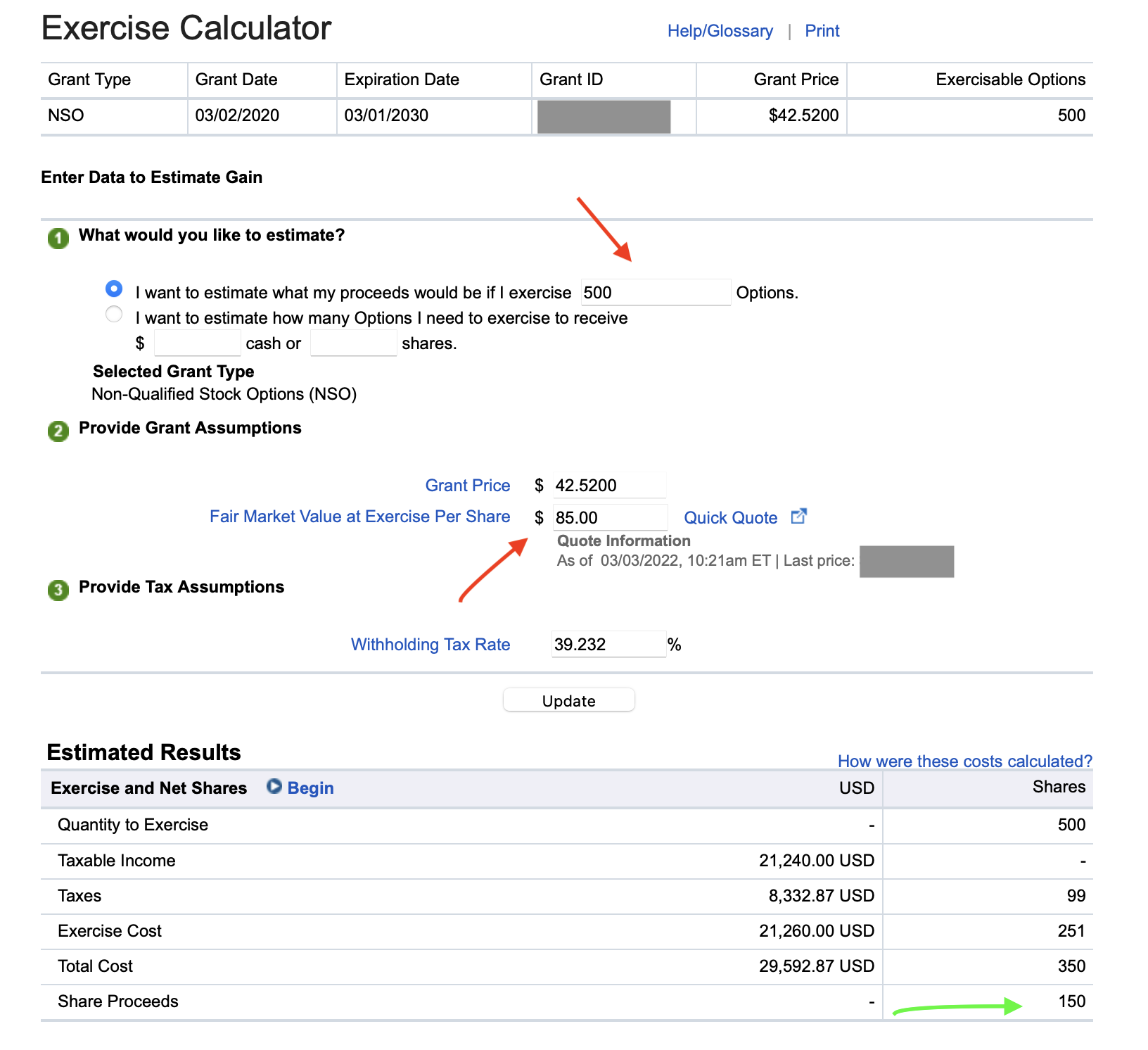

Go to your Stock option Plan section and open the exercise calculator:

Then put in the number of options you want to exercise along with the current stock price:

So if the Stock options were granted when stock price was $42.52 and now the current prices are $85.00 then if I exercise 500 options I’ll end up with 150 stocks. If I change the current price to $43.00 then I’ll end up with only 2 shares.

To be honest, I just know how to use calculator. I don’t know why it’s calculated this way…

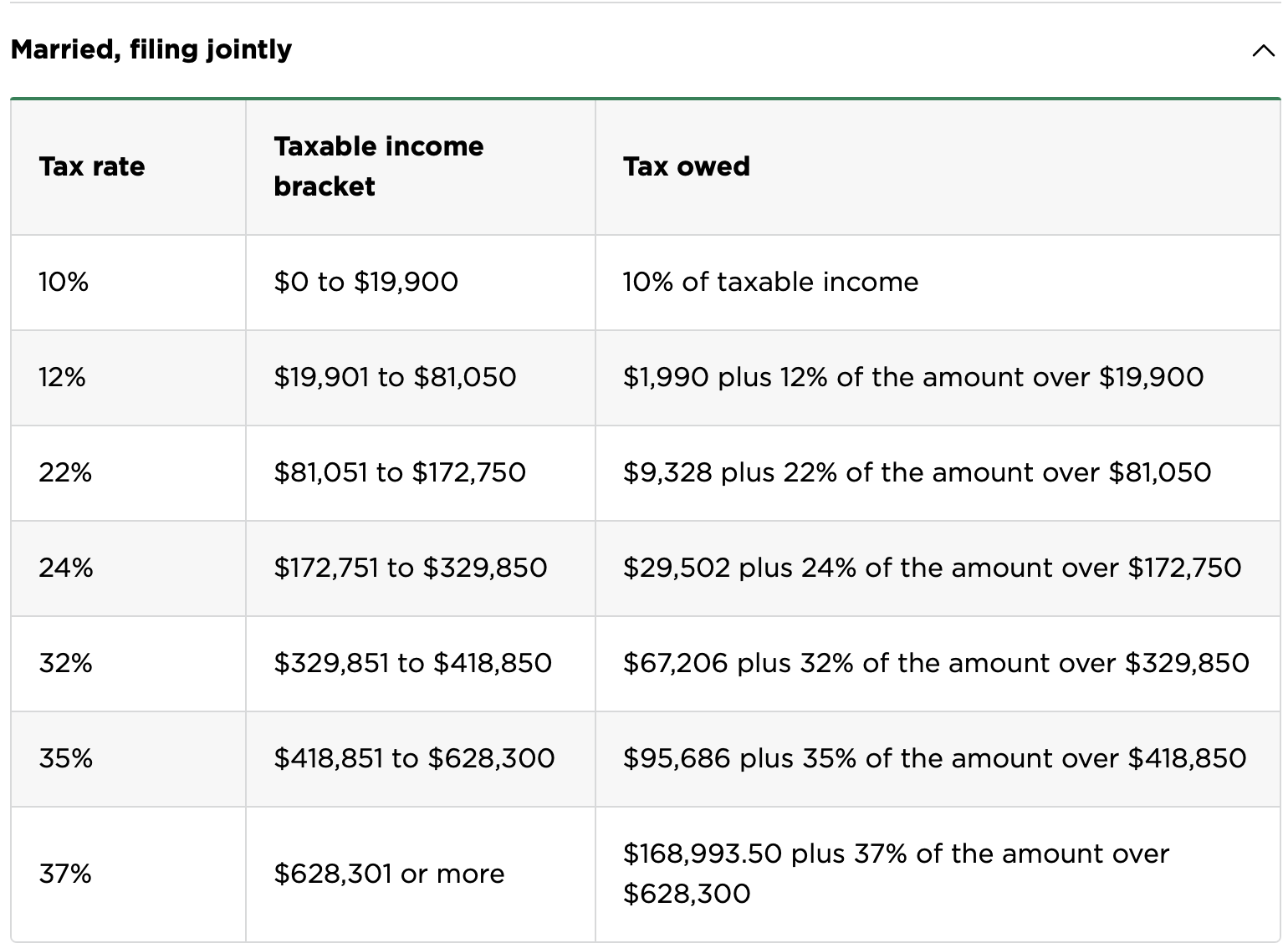

Tax Brackets 2021

Income tax

From nerd wallet

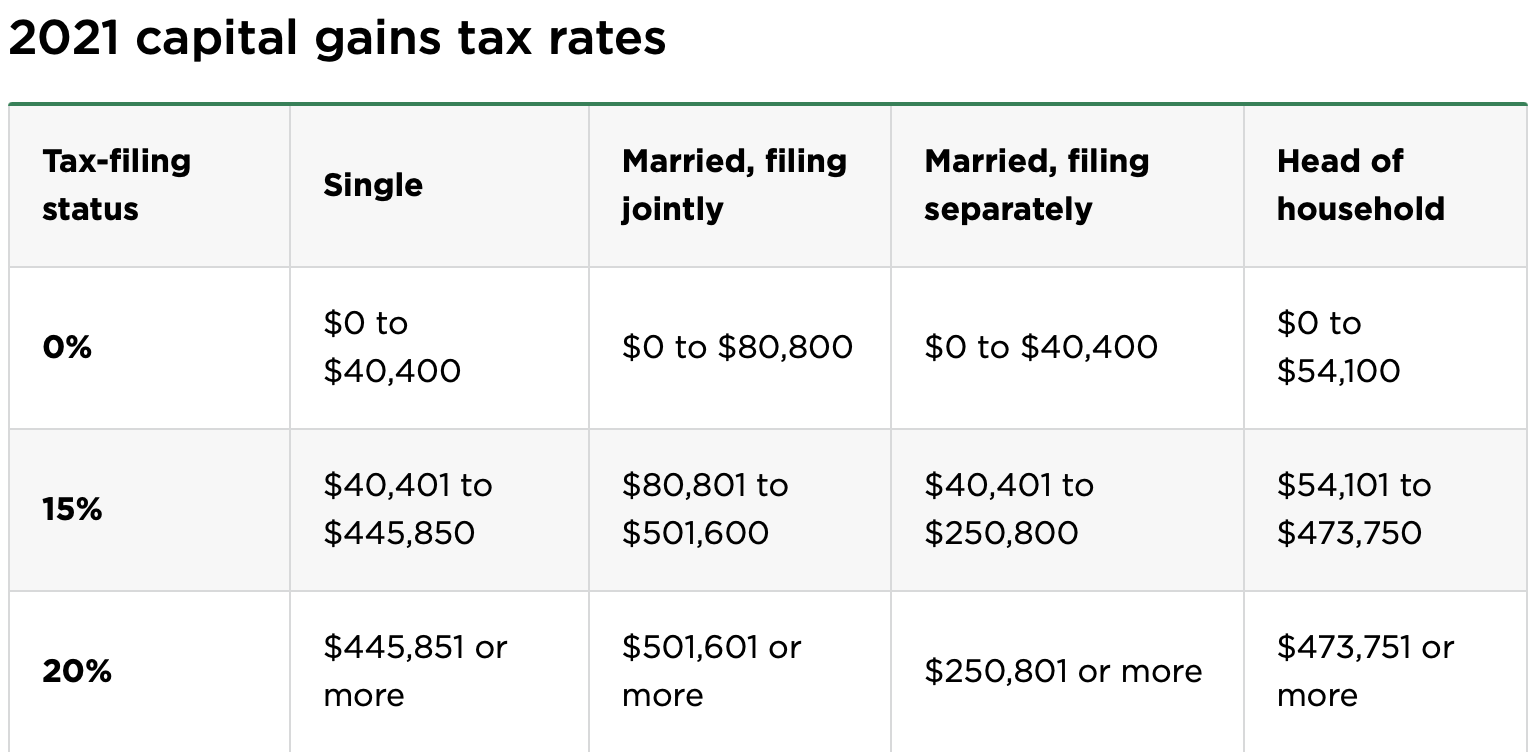

Capital Gain

Note Tax brackets may change every year/president.

What’s the difference between capital gain taxes and income taxes?

Income tax is paid on earnings from employment, interest, dividends, royalties, or self-employment, whether it’s in the form of services, money, or property. Capital gains tax is paid on income that derives from the sale or exchange of an asset, such as a stock or property that’s categorized as a capital asset. For more see InvestoPedia

The rate for capital gain tax rate is usually less that income tax rate.

If you hold the stock for less than one year, your gain will be short term, and you’ll owe ordinary income tax on it If you hold the stock for one year or more, your gain will be long term, meaning you’ll pay tax at the more favorable capital gains rate. For more see TurboTax

(Future Question) What happens if I die? What should I do to make sure everything will get passed along correctly?

I’ll ask and update the post when I find out.

Summary

The Fidelity gives you too many ways to see things. It gets confusing. But if you learn of this structure mentioned above and get to know to use the table format, then things will become easier.